Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. We may also receive compensation if you click on certain links posted on our site.

We may receive compensation from our partners for placement of their products or services. While we are independent, the offers that appear on this site are from companies from which receives compensation. As always, compare your options when considering a business checking account.į is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions.

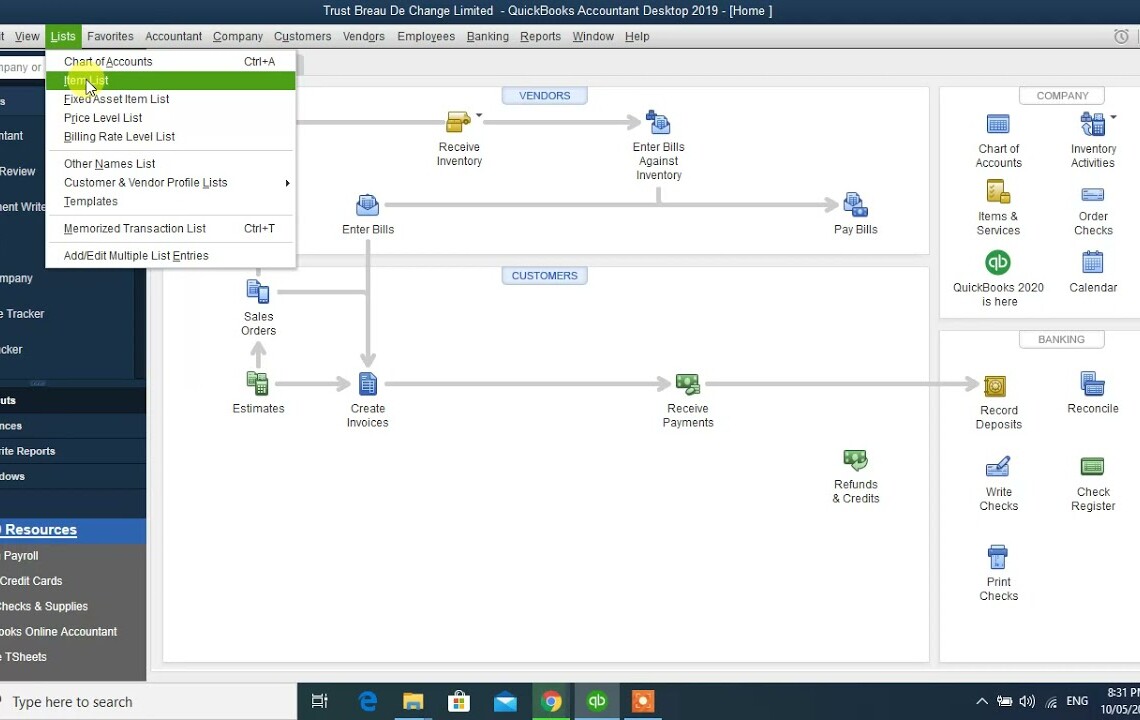

Money by quickbooks software#

If you don’t use or plan to switch to QuickBooks Online for your business accounting software or prefer an account with a larger free ATM network, you’ll want to keep looking. There is no one you can reach out to for questions regarding the QuickBooks Cash account. Other business bank accounts offer access to more fee-free ATMs. While you can withdraw cash at 55,000 ATMs, you’ll pay a $3 withdrawal fee after your fourth monthly withdrawal. You’ll pay $7.50 to $150 a month, depending on your business needs. You’re required to have an active subscription to QuickBooks Online, which isn’t the least-expensive accounting software on the market. While QuickBooks Cash customers are eligible for many benefits, there are some drawbacks as well: Is my money safe with Quickbooks Cash?Īll funds in your QuickBooks Cash account earn interest and are insured by the FDIC through Green Dot Bank. This is in addition to any fees the ATM owner might charge. You’ll pay a $3 fee for any bank-teller transactions or withdrawals from out-of-network ATMs. After your fourth withdrawal, you’ll pay a $3 fee per withdrawal. You can use this card to make purchases anywhere Visa debit cards are accepted, and you can withdraw cash at any of the 55,000 Allpoint ATMs across the country up to four times per month. Some fee-free digital business banks charge a monthly fee to earn interest, but funds in your QuickBooks Cash account will earn 1.25% APY.Īfter opening a QuickBooks Cash account, you’ll receive a QuickBooks debit card in 3 to 5 business days. QuickBooks Cash includes free, instant deposits for any revenue received through QuickBooks Payments. There are no monthly fees, overdraft fees or ATM withdrawal fees with QuickBooks Cash, and there’s no minimum opening deposit. QuickBooks Cash integrates with your accounting and lets you accept payments, pay vendors and employees and manage all of your business’s finances with one tool. Once you’ve opened a QuickBooks Cash account, you’ll have access to the following benefits: What are the benefits of a QuickBooks Cash account?

Driver’s license, state or province-issued ID or a government-issued passport.Social Security number (Contact support at 86 if you don’t have an SSN).You’ll need to provide the following information when you apply:

0 kommentar(er)

0 kommentar(er)